“SaaS Pricing Reimagined: The Path to Enhanced Revenue-Based Financing”

In the ever-evolving landscape of the tech industry, the way SaaS companies price their offerings and secure financing is undergoing a significant transformation. True Sale Financing (TSF) is at the forefront of this revolution, compelling SaaS startups to rethink their pricing strategies and positioning. In this article, we'll explore the world of TSF, with a focus on how Ratio Tech is pioneering innovative options and strategies for empowering startups and SaaS companies. Additionally, we'll dive deep into the significance of leveraging non dilutive financing, like TSF, specifically for startup founders and CEOs in the context of SaaS pricing strategies. We'll highlight the value of accurately gauging the worth delivered to clients and how businesses can capitalize on this value.

What Is True Sale Financing (TSF)? True Sale Financing (TSF) is a financing approach that enables businesses to secure capital without diluting ownership or increasing capital costs. This innovative method involves the sale of assets to lenders, simplifying the financing process while mitigating bankruptcy and credit risk management issues. TSF opens up new avenues for SaaS startups, allowing them to access the much-needed capital to fuel growth without sacrificing equity or incurring excessive debt.

The Power of Non Dilutive Financing for SaaS Pricing: A Strategic Advantage For startup founders and CEOs, non dilutive financing, such as True Sale Financing and Revenue-Based Financing (RBF), holds immense importance, especially in the context of SaaS pricing. These financing models do not hinge on future profits for capital infusion but rather allow lenders to claim a percentage of future sales profits or the total subscriber value. This approach offers startups the flexibility to grow while maintaining control and ownership.

Why SaaS Pricing Matters More Than Ever SaaS pricing is a critical component of a company's success. It's not just about setting a price; it's about understanding your customers, your competition, and the value you provide. In today's competitive market, customers have choices, and they're looking for value. This means that your pricing strategy must align with the value you deliver.

Tiered Pricing: Many SaaS companies opt for tiered pricing models, offering different packages with varying features and prices. This approach allows customers to choose the package that best suits their needs and budget.

Per-Active-User Pricing: Another common model is per-active-user pricing, where customers pay based on the number of users who actively use the software. This pricing model ensures that customers only pay for what they use, which can be appealing for cost-conscious buyers.

Feature Bundling: Some SaaS companies bundle features together, creating different packages for different customer segments. This strategy can be effective in attracting premium customers while still offering a more basic package for budget-conscious buyers.

A Real-World Example: SaaS Pricing Strategies in Action Let's take a look at Tuff Robotics, a fast-growing SaaS company that helps businesses address labor challenges. Tuff Robotics leveraged True Sale Financing provided by Ratio Tech to revolutionize its pricing and service positioning strategy.

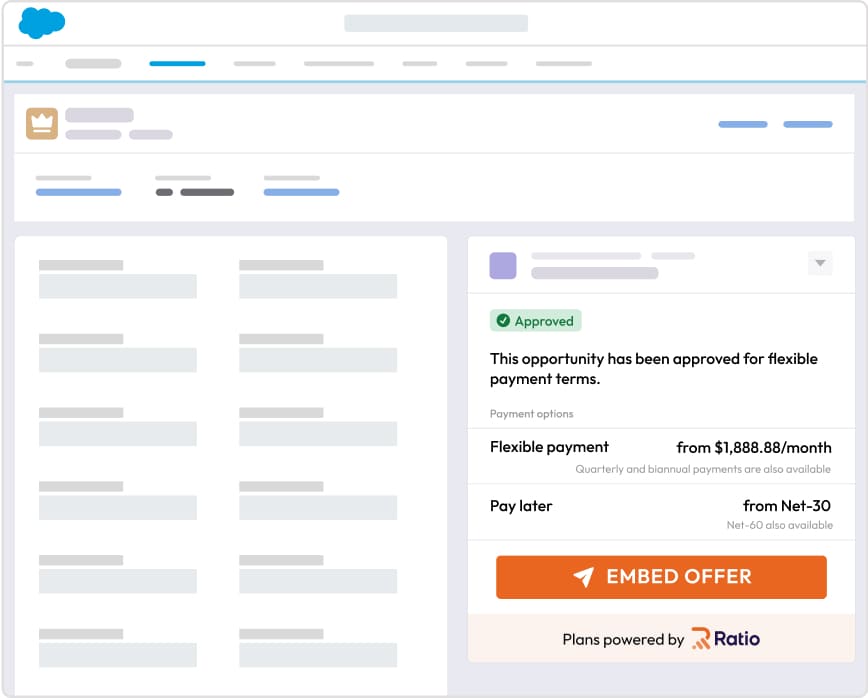

With Ratio Tech's support, Tuff Robotics embedded flexible payment options into every deal, enabling them to close deals faster, especially with cash flow-sensitive customers. This approach allowed Tuff Robotics to collect cash upfront, regardless of how the customer chose to pay. The result? Tuff Robotics not only optimized its SaaS pricing but also increased its enterprise value, thanks to the non dilutive financing offered by Ratio Tech.

Kyle Dou, CEO of Tuff Robotics says, "We're a startup who helps companies with labor challenges. Ratio allows us to continue our mission by extending our financial runway, allowing us to further optimize workflow. With Ratio, we were able to onboard online and get approved almost immediately. We get the opportunity to continue to grow and Ratio gives us the financial resources to do so."

The Role of Data in SaaS Pricing Data plays a significant role in SaaS pricing. By analyzing user behavior, customer preferences, and market trends, SaaS companies can fine-tune their pricing strategies. Advanced analytics and machine learning algorithms help companies segment their customers, understand their willingness to pay, and make data-driven pricing decisions.

Why Ratio Tech Stands Out Ratio Tech is at the forefront of enhancing revenue-based financing and True Sale Financing options for SaaS startups. What sets Ratio Tech apart is its commitment to simplifying the financing process. With swift approvals, user-friendly applications, and substantial financial capacity, Ratio Tech empowers SaaS startups to access up to 80% of their Annual Recurring Revenue (ARR).

Conclusion: A New Era of SaaS Pricing In conclusion, as SaaS pricing continues to evolve, True Sale Financing emerges as a game-changer, offering startups the means to unlock their growth potential without compromising ownership or control. Ratio Tech's innovative approach to revenue-based financing makes them the ideal partner for SaaS startups looking to thrive in this dynamic landscape. With data-driven pricing strategies and non dilutive financing options like TSF, SaaS companies are poised to reshape the future of tech and deliver exceptional value to their clients.

In the ever-evolving landscape of the tech industry, the way SaaS companies price their offerings and secure financing is undergoing a significant transformation. True Sale Financing (TSF) is at the forefront of this revolution, compelling SaaS startups to rethink their pricing strategies and positioning. In this article, we'll explore the world of TSF, with a…

Recent Posts

- Common Types of Dental Emergencies and Effective Ways to Handle Each One

- Trade Pro Roofing: Leading the Way in Roofing Excellence in Springdale, Fayetteville, and NWA

- Key Differences Between Regular Dental Care and Emergency Dental Services

- Ben’s Pest Control: Your Premier Solution for Pest-Free Living

- Maintaining and Caring for Your Quartz Countertops: Tips and Tricks